The #FY2023 books are closed.

What #FY2023 looked like and what #FY2024 entails for Kaito and for the data and analytics market in general.

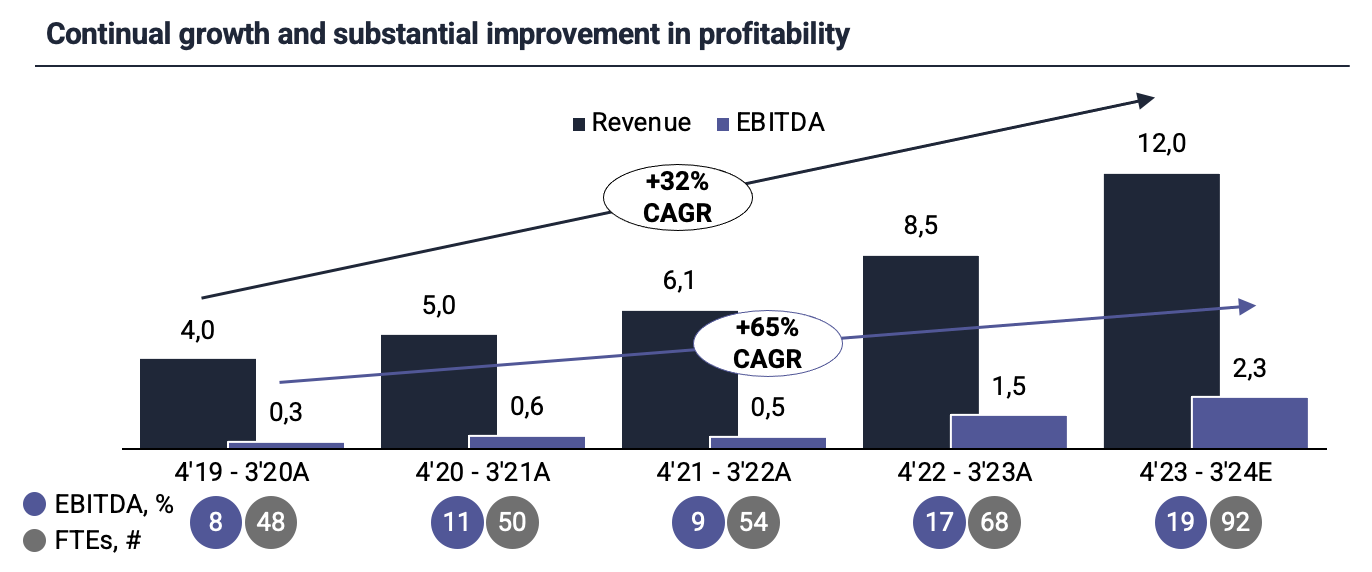

Kaito's FY2023 (4/2022-03/2023) was record breaking. Here are some stats:

- We are 68 awesome colleagues working full time @ Kaito

- Our eNPS is 66

- We did 8.5 meuro revenue with 42% growth YoY

- Our Ebitda was 17% with 88% growth YoY

- More than 30% of Kaito personnel are also company shareholders. A second personnel share issue round carried out successfully beginning of 2023.

- We built strong foothold with our Fast Track offering having multiple customers in development and also live

- Our position within our three strategic focus industries (industrial , finance and retail) grew with remarkable new openings and brand names.

First and foremost I would like to thank all #Kaitonians. Great job all.

I would also like to thank all our customers. The dialogues have been inspiring and you are the reason why we have the chance to do what we love.

What our FY2024 entails:

We continue pushing the boundaries and provide novelty data and analytics solutions for our customers in Nordics. We see exceptional growth potential in financial sector as well as in sustainability analytics (ESG) throuhgout all of our strategic focus industries.

Our focus in leading edge data and analytics technologies like Snowflake and dbt will continue. We will also strengthen our capabilities in Artificial Intelligence and build stronger competence in specific technologies like Databricks.

Our Fast Track offering especially with SAP accelerator will lay a fear over our dear Nordic competitors as there is no more room for traditional data and analytics projects and services that take too much time and lack the provision of real business value. Kaito Fast Track is here to stay. More and more Nordic customers will enjoy agile analytics with the underlying cloud architecture of Azure, Snowflake and dbt - a productized service offering which is 100% code based, fully templated and enables data democratization for the largest enterprises and their divisions.

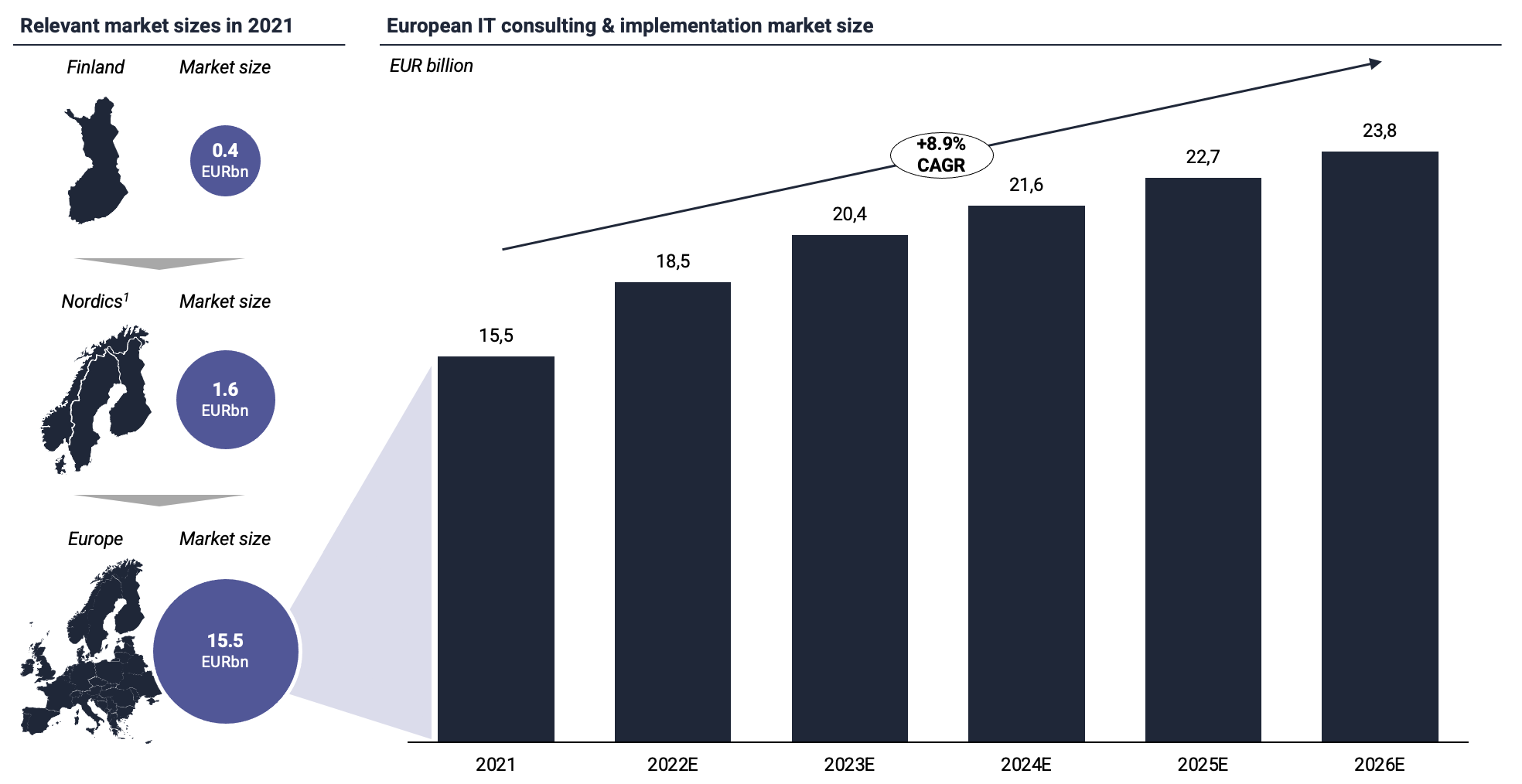

Considering below the trends that apply for IT services market and which are also valid for data & analytics domain, I think we are fully ready to welcome FY2024 and FY2025 at Kaito and make those exceptional as well.

How about the data & analytics market in general*:

- The nature of IT projects is becoming more iterative, recurring and long-term, and the one-off projects spanning over multiple years are decreasing

- IT investments are shifting from impacting business supporting processes to core business processes

- Development in becoming more user-centric, digital service design and customer experience are rising themes that are becoming more important in the selection of IT service providers

- IT services companies are looking for more scalable business models where pricing is based on value provided instead of selling hours

- IT budget control is increasingly shifting from CIOs to leaders of other functions where the services are needed e.g., COOs & CMOs

- The importance of off-shore resources is decreasing as new digital services are difficult to develop fast, reliably and cost efficiently on another continent

Source: Statista

Source: Statista

* Source: Inderes